November 2019 Budget & Expenses | Digital Nomads Pursuing Financial Independence, Retire Early (FI/RE)

This month we topped the scales and spent the most we have in a single month for this entire year, just over $800. Read on to see where we put our extra dollars this month and were we saved big!

This is a recurring monthly series where we share our budget/expenses as digital nomads pursuing financial independence, retire early (FI/RE) and traveling continuously and long-term! So, if you’re wondering how our year to date totals break down each month, or what the trends in our budget/expenses are, then check out the series.

Disclosure: We may receive a commission for links on our blog. You don’t have to use our links, but we’re very appreciative when you do. Thanks again for your support, we hope you find our posts and information helpful!

Tip to Make the Most of This Article

If you’re new to Screw The Average we recommend reading through the entire article, as it gives context to the how and the why of how we budget and spend our money. If you’re already a follower of our Monthly Budget & Expense series then consider skipping to the ‘meat and potatoes’ of it all.

Quick Links

Monthly and Year-To-Date Expenses

We’re often asked how much we budget for our lifestyle of continuous and long-term travel as digital nomads. So we’re pulling the cover off our expenses and sharing what we spend month to month!

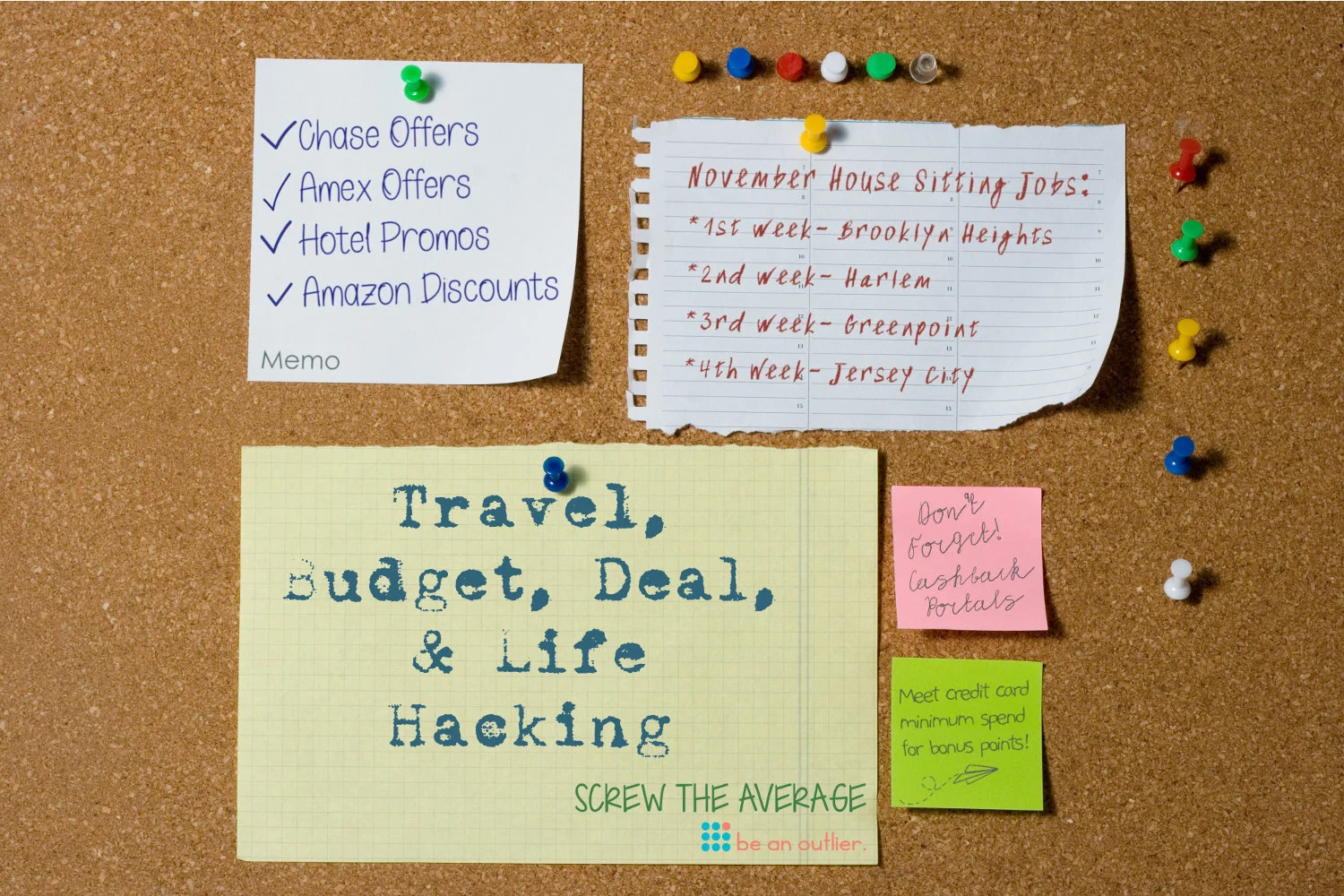

Be prepared; we truly Screw The Average when it comes to our budget/expenses. We have many tricks up our sleeves when it comes to saving money, whether it be for travel (sightseeing, airfare, transportation, etc.), day-to-day expenses (groceries, haircuts, toiletries, etc.), or everything else (gear, supplies, odds and ends, etc.).

“We spend money on what’s important to us: on experiences and on quality and value.”

There are a few reasons why our monthly expenditures are extremely low (relative to most) and dialed in.

+ A Monthly Budget (Or Not)

Budgets have their time and place and do many people a great service. Surprisingly enough though, we don’t keep a budget in the traditional sense because we’re extremely intentional with our decisions, including how we spend money.

Since our living expenses are dialed in, meaning they’re mostly known and similar month to month, and our expenditures are calculated and thought out, we find that we don’t need a budget.

While we don’t keep a budget, as you can see we do track our expenses. This allows us to see trends in our spending and ensure we’re on track. Consider it mindfulness of our finances!

+ Financial Independence, Retire Early (FI/RE)

In its simplest form, reaching (Financial Independence, Retire Early (FI/RE)) means: A) making much more money than you spend, and B) spending much less than you make.

Now whether your put your emphasis on A (make more money) or B (spend less money) is a debate within the FI/RE community and in our opinion a personal decision. And really, either method means living below your means, so ultimately, why not do both?

For us, we’re building FI/RE into our lifestyle. We believe the journey to reach FI/RE doesn’t need to be a 10-20 year grueling grind where it’s the sole focus of life until reached. Don’t get us wrong, we’ve worked our fair share of intense hours and we’ve delayed gratification plenty.

After years of creating a financial, professional, and personal foundation we decided we could incorporate the pursuit of Financial Independence, Retire Early with doing the things we love. We decided that even if it delayed FI/RE a bit, it was well worth it!

+ Freedom

Having a dialed-in, lean, and minimalist lifestyle (and therefore budget) offers us increased freedom. We’ve designed our life in a way that allows us, within reason of course, to make our own decisions, do what we want, and have the upmost flexibility.

We find satisfaction in being able to sleep-in on any given day, take a hike, or play a video game when we choose to.

We’re minimalists when it comes to ‘stuff’, allowing us to get up and go at a moment’s notice.

We only take on the jobs, contracts, or clients we want to and say ‘no thank you’ to the ones that aren’t a good fit.

Thankfully big expenses or unexpected bills don’t put us in debt or throw us for a loop. Because we choose not to inflate our lifestyle to the size of our income we’re able to have an emergency fund.

Once in a lifetime opportunities rarely pass us by because we’re ready for them, whatever they entail.

This freedom isn’t just luck (although we are lucky we haven’t been hit by a meteor or become terminally ill), we fundamentally believe we’re in charge of our own destiny and therefore have worked long and hard for these freedoms. We’ve made thousands of rational, logical choices for decades to get to (where we are today).

Long-Term Travel, FI/RE, and Freedom are Fueled by Our Monthly Budget/Expenses

We don’t consider ourselves cheap, although inevitably some will. We’re frugal, as we worry less about cost and more about value. And finally, we don’t feel we sacrifice; we sometimes delay satisfaction but at other times we live quite luxuriously.

“How we choose to live is very much a personal decision. We don’t for one second believe it’s the only way or even the correct way.”

Where we place our value and therefore our money may not be where you choose to place yours, and that’s okay. We do however hope that just as we’ve learned from other people, maybe others can take a few things away from our approach.

Follow us each month as we post our actual and full expenses. We’ll share tips on how we saved money and insight into where we spent money!

Don’t miss our Ultimate Gear and Packing Lists! Whether you’re traveling long-term or going on a short vacation, we'll show you how to travel with a single carry-on. We share our packing lists (his and hers!), packing tips, and our favorite gear. Plus, we discuss what we don’t carry and why!

Our Expenses: November 2019

If you’re wondering how to travel internationally, or simply vacation nearby and not spend a fortune on airfare or hotels, then we’d like to welcome you to the world of ‘travel hacking’. See what credit cards we carry, and how we take full advantage of the points and miles we’ve earned.

Notable Expenses in November 2019

Upgrading Computers

When we started this adventure in 2016, we purchased two identical computers that would meet our professional needs (IT consultant and project manager/corporate trainer).

We looked high and low for a laptop that offered the ports, speed, power and upgradeability we needed, while still coming in at a low weight (we each carry only a 36 litter backpack after all!).

All things considered, we ultimately chose the Lenovo ThinkPad T series as our laptop of choice.

Three years later and it’s time to update our SSDs (solid state drives). It’s not a coincidence that we made the purchase this month either. Black Friday isn’t just our wedding anniversary, it’s also the day (… well week) of great deals.

Sergio has had his eye on the Samsung 970 EVO Plus 1TB drive for a year! So we were thrilled to stack several deals to get an awesome price. This month’s Real World Travel, Budget, Deal, and Life Hacking details how we got these two drives for $109 apiece (MSRP $250).

Laundry

We rarely spend money on laundry. Typically we’re fortunate enough to have a washer and dryer at a house sit, but if we don’t we sometimes find ourselves washing by hand.

However, this month when we didn’t have access to a washer and dryer and we were extremely busy, we opted to save our time and pay to do a few loads of laundry.

“To clarify, saving money isn’t only a matter of simply not spending it. At the risk of being a bit philosophical, everything in life is a trade off.”

In this case, we can choose to spend our time doing laundry by hand or spend money to machine wash our clothing.

Keeping in mind that time is a limited resource (you can’t buy more of it) and having been pretty busy this month, we opted to allocate our time to things we deemed more important, like time together. It was money well spent!

Tip: When washing by hand we typically just use our hands and soap, but you can make hand washing a bit easier with a Scrubba or something similar.

Notable Savings in November, 2019

Sightseeing

Our sightseeing budget is usually pretty low, if we spend anything in that category at all. To be clear, it’s not that we don’t sightsee though. We’ve actually spent dozens of hours over the last several months exploring different neighborhoods in New York City and seeing some of the popular and historic sites.

So, how do we sightsee for little to nothing each month?

Well, there’s a ton to do that’s always free and then some things that have certain days that are free (like museums)!

We love getting to know a neighborhood by walking it. We end up finding great hidden spots and cool things that most tourists just don’t get a chance to see. Think street art, parks, architecture, etc.

We also look for historical and interesting things that may not make the top 20 things to see in a city. Like a house that’s become a neighborhood icon because of the unique decorations, a park that was the spot of a historic event, or filming locations from well known TV shows or movies.

Then there are things that are well known that just don’t have a ticket price, like Central Park, Times Square, Columbus Circle, FAO Schwarz, etc.

Finally, there are always must see attractions that do cost money. This is when we find deals (like city cards or free entry days), or just pay the ticket price. We had several museums and attractions like this on our NYC must-see list, however we were simply too busy to dedicate to them the time they deserved.

Sadly, museums like the Guggenheim, the MoMA, and the American Museum of Natural History are going to have to wait until next time.

Ultimately, everyone has a different style and we sightsee the way we like. We just happen to enjoy exploring a city more than doing tourist attractions that are usually overpriced and similar in each city. But trust us, we’ve done those as well, just check out our London, United Kingdom, Amsterdam, Netherlands, and Berlin, Germany city guides, just to name a few!

Amex Offers - Starbucks and Airbnb

We’re always on the lookout for Amex, Chase, and Discover Offers. They’re great ways to save money on things you regularly buy or are planning to purchase.

Plus, they’re simple to use. Just login to you account, add the offer to your credit card and make your purchase. Pay with the eligible card and in a short time the offer will reflect in your account!

This month we found a Staples offer for $25 off a $100 purchase on our Hilton Surpass American Express credit card. We don’t need office supplies or printing, but Staples sells gift cards.

We purchased a $50 Starbucks gift card and a $50 Airbnb gift card. Within mere minutes American Express sent us an email confirming our purchase and the $25 cash back!

Tip: See all of the travel, budget, deal, and life hacks we took advantage of this month!

Where We’ve Traveled to This Month

Our month started with the continuation of a house sit in Brooklyn Heights and then took us to Harlem and Greenpoint in New York City. We then ended the month in Jersey City, New Jersey.

This month we had one night at an Airbnb between our Brooklyn Heights house sitting job and our Harlem one. However, thanks to travel hacking and Amex Offers on our Hilton Surpass we’d purchased and Airbnb gift card at 20% off. Meaning our $45 night in Brooklyn was more like $36!

Brooklyn Heights, Brooklyn, New York

This was a our third house sitting job for Barry and the twins, Toretto and Hobbs. We started the house sitting job in October and completed it just short of a week into November.

Toretto and Hobbs are adorable, curious, and energetic Siamese cats that we enjoy each time we’re there!

Harlem, Manhattan, New York

After Brooklyn Heights we had a short (three day) house sitting job in Harlem caring for Dolores. She was adorable, calm, and always up for a good cuddle or play session!

Greenpoint, Brooklyn, New York

In Greenpoint our house sitting job connected us with Alex, who was on her way to Japan to celebrate her birthday with her sister. While we were a bit jealous of her travels to Tokyo, we were excited to care for Berry (aka Toulouse) and Yetti!

First, Alex is among one of the most gracious, generous, and welcoming homeowners we’ve met. She went out of her way to allow us to stay a night early (seriously, she squeezed a queen size air mattress into a New York City sized railroad style apartment) and was just overall kind and upbeat.

Like most pairs of cats, one was super cuddly and outgoing, while the other was a bit more cautious and shy. In this case, Berry was the curious, cuddle loving guy while Yetti only came out to explore a few times during our stay.

Again, thank you for everything Alex!

Jersey City, New Jersey

We’ve been house sitting in the New York City area for a while now, however we’d yet to venture to New Jersey… until last month. Ana and Ben were gracious enough to invite us to sit for their cat Scout and care for their home.

Scout was an absolute pleasure to take care of. He asked for cuddles as soon as we walked in the door, but was also calm and quiet. We had a ton of fun playing with him, especially with a laser pointer!

Our tool box is full of resources! From travel hacking to house sitting, digital nomad jobs to privacy and security, financially independent retire early (FI/RE) to entertainment, plus travel hacking (credit cards, miles, points, and rewards), and much much more…

Year to Date (YTD) Expenses for 2019

Where We’ve House Sat in NYC in 2019

Now that we’re house sitting full time in New York City, we’re including a map of all the neighborhoods we’ve ‘lived in’ so far!

Note: The map is live and will be continuously updated. In other words, if your looking at this post June 2019, you’re also seeing ‘future’ house sits.

See where we are now and everywhere we’ve traveled since we began this adventure in 2016!

London, San Francisco, Paris, New York City, Athens and more?! Trusted Housesitters has allowed us to travel the world on a budget, but more importantly given us an opportunity to make new friends and have cute and cuddly companions along the way. Sign up and start your next great adventure!

Final Thoughts

November was our most expensive month this year, but for good reason. We took advantage of great sales and stacking offers on high priced items that will make our lives more enjoyable and work more productive going forward. We also balanced the overall budget by keeping other expenses low, like food and transportation.

Overall, $800 for a month visiting New York City is still pretty darn cool!